DISCLOSURES & MARKET DISCIPLINE REPORT

FOR THE YEAR ENDED 31 DECEMBER 2023

According to Part Six of Regulation (EU) 2019/2033 of the European Parliament and of the Council on the prudential requirements of investment firms

April 2024

TABLE OF CONTENTS

-

Introduction................................................................3

- CIF Information............................................................3

- Scope of application.........................................................4

- Classification and prudential requirements.......................................4

- Regulatory framework.......................................................5

- Risk management objectives and policies........................................7

1.6. Declaration of the Board.................................................10

-

Corporate Governance......................................................11

- Organisational Structure....................................................11

- Policy on Recruitment......................................................15

- Number of Directorships held by members of the Board...........................16

- Policy on Diversity........................................................16

- Information flow on risk to the board..........................................18

- Own Funds................................................................20

-

Prudential Requirements....................................................25

- Own Funds Requirement....................................................25

- Capital Ratios.............................................................29

- Liquidity Requirement......................................................30

- Reporting requirements.....................................................31

- Other Material Risks.......................................................32

- Internal Capital Adequacy and Risk Assessment Process..........................37

- Remuneration policy and practices............................................38

- Investment Policy...........................................................42

- Environmental, social and governance risks.....................................43

- Appendix – Specific References to the IFR......................................44

LIST OF TABLES

Table 1: Company License Information...........................................4

Table 2: Threshold Criteria.....................................................5

Table 3: Risk Appetite areas....................................................9

Table 4: Number of Directorships of the members of the Board of Directors*.............16

Table 5: Information flow on risk to board........................................19

Table 6: IF CC1.01 - Composition of regulatory own funds as at 31 December 2023.......20

Table 7: EU IF CCA - Main features of own instruments issued by the firm..............22

Table 8: EU IFCC2 - Reconciliation of regulatory own funds to balance sheet in the audited financial statements 24

Table 9: Fixed Overheads Requirement..........................................25

Table 10: Total AUM (average amounts).........................................26

Table 11: Total COH (average amounts)..........................................28

Table 12: K-Factors Results...................................................29

Table 13: Capital Adequacy Analysis............................................30

Table 14: Liquidity Requirements...............................................30

Table 15: Large Exposure Limits...............................................32

Table 16: Remuneration split of staff whose activities have a material impact on the risk profile of the Company 41

Table 17: Remuneration split by business area.....................................41

1. INTRODUCTION

1.1 CIF Information

Israel Interactive Trading Is a Brand of Mexem Ltd hereinafter the ‘Company’) was incorporated in the Republic of Cyprus on 28 January 2016 as a private limited liability company with registration number HE 351726. The Company obtained a Cyprus Investment Firm (“CIF”) licence from the Cyprus Securities and Exchange Commission (“CySEC”), CIF licence No. 325/17 on 15 May 2017 to provide the following Investment and Ancillary Services in trading with the Financial Instruments listed below, in accordance with Part I, II and III of the Law 87(I)/2017:

Investment Services:

Reception and transmission of orders in relation to one or more financial instruments (1)

Provision of Investment Advice (5)

Portfolio Management (4)

Note: In brackets (...) is the number of the investment service as referred in the Law 87(I)/2017.

Ancillary Services:

Investment research and financial analysis or other forms of general recommendation relating to transactions in financial instruments. (5)

Note: In brackets (...) is the number of the ancillary service as referred in the Law 87(I)/2017.

Financial Instruments:

- Transferable Securities (1)

- Money Market Instruments (2)

- Units in Collective Investment Undertakings (3)

- Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields, or other derivatives instruments, financial indices or financial measures which may be settled physically or in cash (4)

- Options, futures, swaps, forward rate agreements and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties (otherwise than by reason of a default or other termination event) (5)

- Options, futures, swaps, and any other derivative contract relating to commodities that can be physically settled provided that they are traded on a regulated market or/and an MTF (6)

- Options, futures, swaps, forwards and any other derivative contracts relating to commodities, that can be physically settled not otherwise mentioned in point 6 of Part III and not being for commercial purposes, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are cleared and settled through recognised clearing houses or are subject to regular margin calls (7)

- Derivative instruments for the transfer of credit risk (8)

- Financial contracts for differences (9)

- Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates, emission allowances or inflation rates or other official economic statistics that must be settled in cash or may be settled in cash at the option of one of the parties (otherwise than by reason of a default or other termination event), as well as any other derivative contract relating to assets, rights, obligations,

indices and measures not otherwise mentioned in this Part, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are traded on a regulated market or an MTF, are cleared and settled through recognised clearing houses or are subject to regular margin calls. (10)

Note: In brackets (...) is the number of the financial instrument as referred in the Law 87(I)/2017. The table below illustrates the current licence information of the Company:

Table 1: Company License Information

|

|

Investment Services and Activities |

Ancillary Services |

||||||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

||

|

1 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

- |

- |

|

- |

- - - - - |

|

|

2 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

|||||

|

3 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

|||||

|

4 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

|||||

|

5 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

|||||

|

6 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

- |

||||

|

7 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

- |

||||

|

8 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

- - |

||||

|

9 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

|||||

|

10 |

|

- |

- |

|

|

- |

- |

- |

- |

- |

|

- |

||||

|

11 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

||||

1.2 Scope of application

The Disclosures and Market Discipline Report (the ‘Report’) is prepared on an individual (solo) basis in accordance with the disclosure requirements as laid out in Part Six of the IFR. Investment firms are required to disclose their capital resources, capital requirements, remuneration policies, practices and governance standards.

The Report has as a starting point the financial information used in the Company’s Financial Statements which are prepared in accordance with the International Financial Reporting Standards (“IFRS”). As the two documents serve different purposes, the reported figures illustrate differences, which lie on the differences of the fundamental concepts between the IFR and the IFRS.

1.3 Classification and prudential requirements

Under current prudential regulatory framework, Investment Firms Directive (EU) 2019/2034 (“IFD”) and Investment Firm Regulation, Regulation (EU) 2019/2033 (“IFR”), all investment firms are classified as Class 1, 2 or 3 Investment Firms, based on their activities, systemic importance, size and interconnectedness. Class 1 Investment Firms are the largest and most interconnected investment firms, with risk profiles similar to those of significant credit institutions, have equal treatment with credit institutions in the sense of a level playing field accordingly and they fall entirely under the CRR.

Investment Firms categorized as Class 2 and Class 3 must comply with the provisions of the IFR/IFD prudential regulatory regime for investment firms introduced back in June 2021. CIFs that meet all of the below criteria are categorised as Class 3 Investment Firms, while when they exceed any of the following specific size thresholds, are categorised as Class 2 Investment Firms.

Table 2: Threshold Criteria

|

No. |

Metric |

Thresholds |

|

1. |

Assets Under Management |

<€1.2 billion |

|

2. |

Client orders handled – cash trades |

< €100 million per day |

|

3. |

Client orders handled – derivative trades |

<€1 billion per day |

|

4. |

Assets safeguarded and administered |

zero |

|

5. |

Client money held |

zero |

|

6. |

On- and off-balance sheet total |

< €100 million |

|

7. |

Total annual gross revenue from investment services and activities |

< €30 million |

The Company has exceeded the threshold condition of COH being less than €100 million/day for cash trades and, as such, it is classified as Class 2 Investment Firm.

In light of the above, the Company should maintain own funds of at least the higher between:

A. Permanent minimum capital requirement

The permanent minimum capital requirement of the Company is €75k since it is not authorized to provide the investment service of dealing on own account or permitted to hold clients’ money.

However, the Company has submitted an application to CySEC for a licence extension to include the investment service of Safekeeping and Administration of financial instruments for the account of clients which was approved.

Upon activation of the ancillary service of Safekeeping and Administration of financial instruments for the account of clients, the Company’s Initial Capital will increase to €150k.

B. Fixed overhead requirements

The Fixed Overheads Requirement is calculated as one quarter (¼) of the previous year fixed expenses (based on audited figures).

C. K-Factors requirement

The K-Factors are quantitative indicators that reflect the risk that the IFR/IFD prudential regime intends to address. Specifically, capital requirements from applying the K-factors formula (pursuant to Article 15 of the IFR) is the sum of the Risk to Client (‘RtC’), Risk to Market (‘RtM’) and Risk to Firm (‘RtF’) proxies.

1.4 Regulatory framework

The Report has been prepared in accordance with the regulatory regime for investment firms that the European Parliament has adopted, the IFR and the IFD as well as the relevant provisions of the Law 165(I)/2021 “The Prudential Supervisions for Investment Firms Law of 2021” (the “Law”) and the Law 164(I)/2021, amending Law 97(I)/2021, “The Capital Adequacy Investment Firms Law of 2021”.

The IFR establishes the prudential requirements in terms of own funds, level of minimum capital, concentration risk, liquidity requirements and level of activity with respect to EU investment firms. Furthermore, IFR introduced significant changes in the prudential regulatory regime

applicable to Investment Firms, including a new classification system, an amended minimum initial capital requirement and minimum capital ratios, changes in the calculation of capital requirements, variations in reporting requirements, internal governance policies, the introduction of the K-Factors methodology and practices relating to liquidity requirements, large exposures and consolidation requirements.

The Regulatory framework consists of:

• Basic Prudential Requirement - Covers minimum capital and liquidity requirements.

• Internal Capital and Liquidity Adequacy Assessment – Regulates the investment firm’s accountability to the regulator for capital and liquidity adequacy. If the regulator deems the capital to be insufficient, a corrective requirement can be imposed on the company in the form of what is known as a ‘SREP’.

• Disclosures Requirement - require the disclosure of information regarding the prudential requirements, risk management and principles of the remuneration policy.

The Company has a formal policy, approved by the Board of Directors (‘Board’ or ‘BoD’), which details its approach in complying fully with the market disclosure requirements as laid out in Part Six of the IFR.

The provisions on disclosure requirements are described in Articles 46 to 53 of the IFR. In addition, these disclosures must be verified by the external auditors of the CIF. The CIF will be responsible to submit its external auditors’ verification report to CySEC. The Company has included its risk management disclosures on its website.

Materiality is based on the criterion that the omission or misstatement of information would be likely to change or influence the decision of a reader relying on that information for the purpose of making economic decisions. Where the Company has considered a disclosure to be immaterial, this was not included in the document.

Frequency

The Company’s policy is to publish the disclosures required on an annual basis. The frequency of disclosure will be reviewed should there be a material change in approach used for the calculation of capital, business structure or regulatory requirements.

Location of publication

The Company’s Disclosures and Market Discipline Report is published on the Company’s official website:

Verification

The Company’s Disclosures and Market Discipline Report is subject to internal review and validation prior to being submitted to the Board for approval. The Report has been reviewed and

approved by the Board. In addition, the Remuneration disclosures have been reviewed by the Risk Manager.

1.5 Risk management objectives and policies

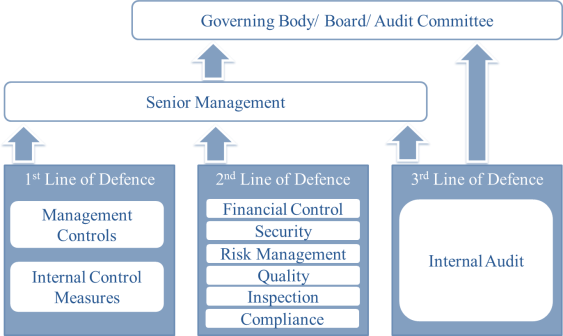

To ensure effective risk management, the Company has adopted the Three Lines of Defence model, with clearly defined roles and responsibilities.

First Line of Defence: Managers are responsible for establishing an effective control framework within their area of operation and identifying and controlling all risks so that they are operating within the organisational risk appetite and are fully compliant with the Company’s policies and where appropriate defined thresholds. The First Line of Defence acts as an early warning mechanism for identifying (or remedying) risks or failures.

Second Line of Defence: The Risk Management Function is responsible for proposing to the Board appropriate objectives and measures to define the Company’s risk appetite, devising the suite of policies necessary to control the business including the overarching framework, independently monitoring the Company’s risk profile and providing additional assurance where required. The Risk Management Function will leverage their expertise by providing frameworks, tools and techniques to assist management in meeting their responsibilities, as well as acting as a central coordinator to identify enterprise-wide risks and make recommendations to address them. Integral to the mission of the Second Line of Defence is identifying risk areas, detecting situations/activities in need of monitoring, and developing policies to formalise risk assessment, mitigation and monitoring.

Third Line of Defence: Comprised by the Internal Audit Function which is responsible for providing assurance to the Board on the adequacy of design and operational effectiveness of the systems of internal controls. Internal Audit undertakes on-site inspections/visits to ensure that the responsibilities of each Function are discharged properly (i.e. soundly, honestly and professionally) as well as reviewing the Company’s relevant policies and procedures. Internal Audit works closely with both the First and Second Lines of Defence to ensure that its findings and recommendations are taken into consideration and followed, as applicable.

1.5.1 Risk Management Framework

Managing risk effectively in a Company operating in a continuously changing risk environment, requires a strong risk management culture. As a result, the Company has established an effective risk oversight structure and the necessary internal organisational controls to ensure that the Company undertakes the following:

Adequate risk identification and management,

Establishment of the necessary policies and procedures,

Setting and monitoring of relevant limits, and

Compliance with the applicable legislation.

The Board meets on a regular basis and receives updates on risk and regulatory capital matters from management. The Board reviews regularly (at least annually) written reports concerning compliance, risk management and internal audit policies and procedures as well as the Company’s risk management policies and procedures as implemented by Management.

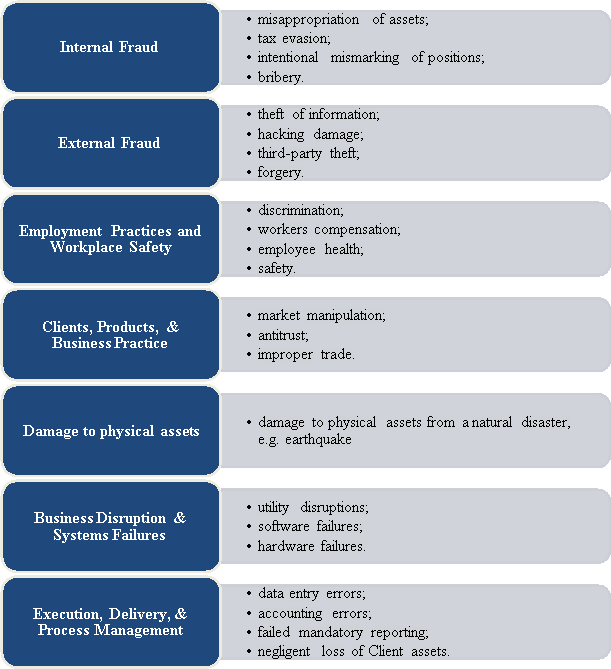

As part of its business activities, the Company faces a variety of risks, the most significant of which are described further below. The Company holds regulatory capital against the three all- encompassing main types of risk: credit risk, market risk and operational risk.

1.5.2 Risk Statement

The Company's activities expose it to a variety of risks, and in particular to credit risk, market risk, operational risk, compliance risk, regulatory risk, reputational risk, group risk, strategic risk, liquidity risk, conduct risk etc. The Company, through its operations, has a significant exposure to the economies and financial markets.

As regards the management of the risks arising from the current macroeconomic and political uncertainty (heightened inflation, Ukrainian crisis, climate crisis etc.), the Company is following the local government guidelines, enhancing its onboarding procedures and closely monitoring its capital and liquidity positions.

Risk Strategy

The risk strategy of the Company is the responsibility of the Board, which formulates it and is responsible for monitoring its implementation. This is achieved through the development of risk management processes and procedures as well as through an assessment of the risks undertaken and the effectiveness of the risk management framework, given the Company’s business model. One important characteristic of the Company’s risk strategy is the alignment with the strategic and operational targets that are set by the Board.

The risks that arise from the implementation of the Company’s strategic and business plans are regularly analyzed in order to ensure the adequacy of the relevant policies, procedures and systems.

The risk strategy of the Company aims to provide to both Senior Management and employees a general risk framework for the management of the different types of risks in line with the overall risk management and risk bearing capacity of the Company. The Company recognizes the importance of risk management to its business’ success, and therefore the overall objective is to

establish effective risk management policies that are able to mitigate the Company’s exposure to various risks.

Risk Appetite

Risk appetite is the level and type of risk a firm is able and willing to assume in its exposures and business activities, given its business objectives and obligations to stakeholders. Risk appetite is generally expressed through both quantitative and qualitative means and should consider extreme conditions, events and outcomes. In addition, risk appetite should reflect potential impact on earnings, capital and funding/liquidity.

The Company has a low-risk appetite with respect to investing and managing business and operational activities.

According to the Financial Stability Board (FSB), an appropriate risk appetite framework (RAF) should enable risk target, risk appetite, risk limits and risk profile to be considered for business lines and legal entities as relevant, and within the group context.

The Risk appetite framework is defined as the overall approach, including policies, processes, controls, and systems through which risk appetite is established, communicated, and monitored.

Moreover, it includes a risk appetite statement, risk limits, and an outline of the roles and responsibilities of those overseeing the implementation and monitoring the RAF.

The RAF should consider material risks to the financial institution, as well as to the institution’s reputation vis-à-vis policyholders, depositors, investors and customers. The RAF aligns with the institution's strategy. The Company is assessing its risk appetite with respect to investing and managing business and operational activities while the Company’s Risk Appetite Statement is prepared by the Risk Manager and approved by the Board of Directors.

Table 3: Risk Appetite areas

|

Indicator |

Normal 1 |

Warning 2 |

Limit 3 |

|

Minimum Own Fund Requirement |

≥€1,000k |

<€1,000k |

€755k |

|

Common Equity Tier 1 Ratio4 |

>100% |

<75% |

56% |

|

AT1 Capital Ratio4 |

>125% |

<100% |

75% |

|

Total Capital Ratio4 |

>150% |

<125% |

100% |

|

Liquid Assets |

>€300k |

<€300k |

€252k |

|

Return on Assets |

≥5.00% |

<5.00% |

0.00% |

|

Retained Earnings / Total Equity |

≥10.00% |

<10.00% |

5.00% |

Notes:

- The level of the indicator is within the acceptable limits as per the Company’s risk appetite.

- The Company should take proactive actions in order to ensure that the level of the indicator will remain above the acceptable limits.

- The level of the indicator falls below the acceptable limits and as such the Company should proceed with the required actions in order to restore the level of the said indicator to the normal predefined levels.

- Additional own funds requirement and additional 18.75% total capital ratio requirement as per the paragraph 18 of the Law 20(I)/2016 have been taken into consideration for Normal and Warning thresholds.

The Risk Appetite framework has been designed to create links to the strategic long-term plan, capital planning and the Company’s risk management framework.

The Board approves the Company’s corporate strategy, business plans, budget, long term plan and ICARA. The Company employs mitigation techniques defined within the Company’s policies, to ensure risks are managed within its Risk Appetite.

1.5.3 Risk Culture

Risk culture is a critical element in the Company’s risk management framework and procedures. Management considers risk awareness and risk culture within the Company as an important part of the effective risk management process. Ethical behaviour is a key component of the strong risk culture, and its importance is also continuously emphasised by the management.

The Company is committed to embedding a strong risk culture throughout the business where everyone understands the risks they personally manage and are empowered and qualified to take accountability for them. The Company embraces a culture where each of the business areas are encouraged to take risk–based decisions, while knowing when to escalate or seek for advice.

1.6. Declaration of the Board

The Board is required to proceed with an annual declaration on the adequacy of the Company’s risk management framework and ensure that the risk management arrangements and systems of financial and internal control in place are in line with the Company’s risk profile.

The Company’s risk management framework is designed to identify, assess, mitigate and monitor all sources of risk that could have a material impact on the Company’s operations. The Board considers that the Company has in place adequate systems and controls with regards to its size, risk profile and strategy and an appropriate array of assurance mechanisms, properly resourced and skilled, to avoid or minimise loss. Key ratios and figures representing interaction of

the risk profile and the stated risk tolerances are deemed to be proprietary information.

2. CORPORATE GOVERNANCE

The Company’s systems of risk management and internal control include risk assessment, management or mitigation of risks, including the use of control processes, information and communication systems and processes for monitoring and reviewing their continuing effectiveness.

The risk management and internal control systems are embedded in the operations of the Company and are capable of responding quickly to evolving business risks, whether they arise from factors within the Company or from changes in the business environment.

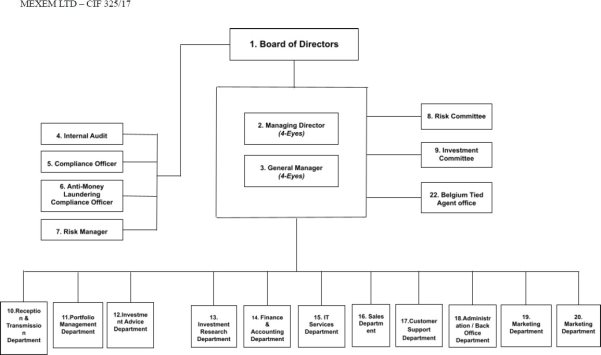

2.1. Organisational Structure

The Company’s latest organizational structure is as follows:

Through the said structure, the Company incorporates a strict Internal Governance framework. Furthermore, the Organisational Structure incorporates the various organisational and functional reporting lines, as well as the different roles and responsibilities therein, while it also facilitates the compliance of the Company with the principle of segregation of duties and helps in the avoidance and control of possible conflict of interest situations within the Company.

The Company has in place an Internal Operations Manual which lays down the activities, processes, duties and responsibilities of the Board, Committees, Senior Management and staff constituting the Company.

Moreover, the Company implements and maintains adequate risk management policies and procedures which identify the risks relating to the Company’s activities, processes and systems, and where appropriate, sets the level of risk tolerated by the Company. The Company adopts effective arrangements, processes and systems, in light of the set level of risk tolerance, where applicable.

2.1.1. Board of Directors

As at 31 December 2023, the Board comprised of three executive directors and two non- executive directors.

The Board has the ultimate and overall responsibility for the investment firm and defines, oversees and is accountable for the implementation of the governance arrangements. The Board is responsible for ensuring that the Company complies at all times with its obligations under the Law. In doing so, the Board approves and periodically reviews the effectiveness of the policies, arrangements and procedures put in place, whilst if needed, takes appropriate measures to address any deficiencies.

The main responsibilities of the Board of Directors are:

1. To establish, implement and maintain decision-making procedures and an organizational structure which clearly and in documented manner specifies reporting lines and allocates functions and responsibilities;

2. To ensure that its relevant persons are aware of the procedures that must be followed for the proper discharge of their responsibilities;

3. To establish, implement and maintain adequate internal control mechanisms designed to secure compliance with decisions and procedures at all levels of the CIF;

4. To employ personnel with the skills, knowledge and expertise necessary for the discharge of the responsibilities allocated to them;

5. To establish, implement and maintain effective internal reporting and communication information at all relevant levels of the CIF;

6. To maintain adequate and orderly records of its business and internal organization; and

7. To ensure that the performance of multiple functions by its relevant persons does not and is no likely to prevent those persons from discharging any particular function soundly, honestly, and professionally.

The Board has the overall responsibility for the establishment and oversight of the Company’s Risk Management Framework. The Board satisfies itself that financial controls and systems of risk management are robust.

2.1.2. Risk Manager

Further to the formation of the overall Internal Governance Framework, it should be noted that the Board has appointed a Risk Manager to ensure that all the different types of risks taken by the Company are in compliance with the Law and the obligations of the Company under the Law, and that all necessary procedures, relating to risk management are in place and are functional on an operational level from a day-to-day basis. The Risk Manager reports directly to the Senior Management of the Company while as previously discussed, the Risk Management Committee is responsible to control and overview the Risk Manager’s actions/ performance at work.

The Risk Manager, has the following responsibilities:

1. Design the overall risk management system of the Company;

2. Comply and implement the relevant provisions of the Law;

3. Prepare the Risk Management policies and procedures;

4. Provide training to relevant employees and the Senior Management, on risk-related issues;

5. Analyze the market and its trends;

6. Evaluate the effect of the introduction of any potential new services or activities on the Company’s risk management;

7. Measures for the monitoring of capital adequacy and large exposures;

8. Draft written reports to the Board including recommendations;

9. Monitor Client and counterparty limits;

10. Identify and manage the overall risks faced by the Company;

11. Establish methods for risk monitoring and measurement;

12. Monitor the performance and overall actions of the Dealing on Own Account Department;

13. Prepare and implement the ICARA of the Company;

14. Apply stress testing scenarios and undertake analysis of the results;

15. Review the policy on maximum limits with respect to liquidity risk and market risk;

16. Identify the instruments that are qualified as liquid assets;

17. Ensure that data for the calculation of the K-Factors requirement are available at all times; and

18. Fulfil the disclosure requirements under part six of IFR based on the categorization of the Company.

2.1.3. Committees

Establishing committees helps management bodies in their supervisory function. Committees draw on the specific knowledge and areas of expertise of individual management body members. While committees should prepare decisions and make recommendations to the management body in its supervisory function, the management body has the overall responsibility.

According to Circular C487, if the Company meets the definition of ‘significant CIF’ as set out in Section 26(8)(a) of the Law, it is obligated to establish a Risk, Remuneration and Nomination Committee. The Company does not fall under the definition of ‘significant CIF’ since its average on and off-balance sheet items during the four preceding years were less than €100m. Therefore, it is not required to comply with the additional regulatory requirements indicated above.

However, the Company has established a Risk Management Committee and Investment Committee in order to ensure the effectiveness of the risk management and investment policies and procedures.

Investment Committee

An Investment Committee has been formed to ensure the implementation of a prudent investment policy and effective monitoring of the provision of adequate investment services to Clients. The Investment Committee decisions shall relate to general and overall decisions as far as the investments are concerned which correspond to the Client’s risk profile categories or the Company’s risk profile, as applicable. These general and overall decisions relate to various sectors of the economy across multiple regions and countries, general macroeconomic indicators, types of Financial Instruments, types of financial markets and market segments.

Furthermore, these decisions are notified to the relevant Heads of Departments of the Company, as necessary, to enable discharging of their duties in an effective manner. As far as investments are concerned and when related to specific investment strategies, these decisions are of a prescribed content.

During 2023, the Investment Committee convened four (4) times.

Risk Management Committee

The Risk Management Committee of the Company is formed with the view of ensuring the efficient monitoring of the risks inherent in the provision of investment and ancillary services to Clients, as well as the overall risks underlying the operations of the Company. To this effect, the Company has adopted and maintains an applied risk management framework/policy, which identifies the risks relating to the Company’s activities, processes and systems and sets the risk tolerance levels of the Company.

The Risk Management Committee bears the responsibility to monitor the adequacy and effectiveness of the risk management framework/policy and procedures that are in place, the level of compliance by the Company and its relevant persons with the policies and procedures adopted as well as the adequacy and effectiveness of measures taken to address any deficiencies with respect to those policies and procedures that are in place, including failures by the Company’s relevant persons to comply with those policies and procedures.

Furthermore, the risk management committee advises the management body on the investment firm’s overall current and future risk appetite and strategy and assists the management body in overseeing the implementation of that strategy by senior management.

2.1.4. Other Governance Functions Internal Audit Function

The Internal Auditor reports to the Senior Management and the Board of the Company and is separated and independent from the other functions and activities of the Company. The Internal Auditor has access to the Company’s premises, systems, information, personnel and financials. The Board ensures that internal audit issues are considered when presented to it by the Internal Auditor and appropriate actions are taken according to the Board’s assessment and prioritization. Moreover, the qualifications of the committee members should entail sufficient academic background, extensive knowledge of and exposure to the capital markets and financial services industry, and high level of knowledge and understanding of the legal framework under which the Company is regulated.

Compliance Function

Pursuant to the regulatory obligations of the Company and with the view to complement the Internal Governance framework of the Company, the Board has established a compliance function to manage compliance risk. Furthermore, the Board has appointed the Compliance Officer (the “CO”) who is to be responsible for this function across the entire investment firm. More specifically, the CO is responsible to establish, implement and maintain adequate policies and procedures designed to detect any risk of failure by the Company to comply with its obligations, to put in place adequate measures and procedures designed to minimize such risks and to enable the competent authorities to exercise their powers effectively. The compliance function, policies and procedures should also be compliant with Article 22 of Commission Delegated Regulation (EU) 2017/565 and ESMA guidelines on the compliance function.

The Compliance Officer is independent and reports directly to the Senior Management of the Company, having at the same time the necessary authority, resources, expertise and access to all relevant information. The staff within the compliance function possess sufficient knowledge, skills and experience in relation to compliance and relevant procedures and have access to regular training.

Anti-Money Laundering Compliance Officer

The Board retains a person for the position of the Company’s Anti-Money Laundering Compliance Officer (hereinafter the “AMLCO”) to whom the Company's employees report their knowledge or suspicion of transactions involving money laundering and/or terrorist financing. The AMLCO belongs to the higher hierarchical levels/layers of the Company so as to command the necessary authority. The AMLCO leads the Company’s Anti-Money Laundering Compliance procedures and processes and reports to the Senior Management and the Board of the Company.

2.2. Policy on Recruitment

Recruitment into the Board combines an assessment of both technical capability and competency skills references against the Company’s leadership framework. Members of the Board possess sufficient knowledge, skills and experience to perform their duties. The overall composition of the Board reflects an adequately broad range of experiences to be able to understand the CIF’s activities, including the main risks to ensure the sound and prudent management of the Company as well as sufficient knowledge, of the legal framework governing the operations of a CIF.

Board of Directors Recruitment

The management of a CIF must be undertaken by at least two persons meeting the requirements below:

- Members of the Board shall at all times be of sufficiently good repute and possess sufficient knowledge, skills and experience to perform their duties. The overall composition of the Board of directors shall reflect and adequately board range of experiences.

- All Board members shall commit sufficient time to perform their functions in the Company;

-

The number of directorships which may be held by a member of the Board at the same time shall take into account individual circumstances and the nature, scale and complexity of the Company’s activities. Unless representing the Republic, members of the Board of a CIF that is significant in terms of its size, internal organisation and the nature, the scope and the complexity of its activities shall not hold more than one of the following combinations of directorships at the same time:

- one executive directorship with two non-executive directorships;

- four non-executive directorships.

- For the purposes of subsection above, the following shall count as a single directorship:

- Executive or non-executive directorships held within the same group;

-

Executive or non-executive directorships held within:

- institutions which are members of the same institutional protection scheme provided that the conditions set out in Article 113, paragraph (7) of CRR are fulfilled; or

- undertakings (including non-financial entities) in which the CIF holds a qualifying holding.

- Directorships in organisations which do not pursue predominantly commercial objectives shall not count for the purposes of the previous subsection;

- The Commission may allow members of the Board of Directors to hold additional non- executive directorships;

- The Board of Directors shall collectively possess adequate knowledge, skills experience to be able to understand the Company’s activities, including the principal risks; and

- Each member of the Board of Directors shall act with honesty, integrity and independence of mind to effectively assess and challenge the decisions of the senior management where necessary and to effectively oversee and monitor the decision-making of the management.

Chairman of the BoD shall not exercise simultaneously the functions of a Chief Executive Officer within the Company, unless justified by the Company and approved by CySEC.

2.3. Number of Directorships held by members of the Board

The table below discloses the number of directorships held by members of the management body of the Company, including Mexem Ltd and any other companies belonging to the same group, as at 31 December 2023. Directorships in organisations which do not pursue predominantly commercial objectives such as non-profit or charitable organisations, are not taken into account for the purposes of the below.

Table 4: Number of Directorships of the members of the Board of Directors*

|

Name of Director |

Position |

Number of Executive Directorships |

Number of Non- Executive Directorships |

|

Mr. Enosh Aharoni |

Executive Director |

1 |

3 |

|

Mr. Tomer Chubara |

Executive Director |

2 |

- |

|

Mr. Daniel Yakov Arad |

Executive Director |

10 |

- |

|

Mr. Eliahu Shirazi |

Non-Executive Director |

4 |

1 |

|

Mrs. Stella Kattashi |

Non-Executive Director |

1 |

1 |

*The information in this table is based only on representations made by the directors of the Company.

For the purpose of the above, Executive or Non-Executive directorships held within the same group shall count as a single directorship.

2.4. Policy on Diversity

The Company is committed to promoting a diverse and inclusive workplace at all levels, reflective of the communities in which it does business. It approaches diversity in the broadest sense, recognizing that successful businesses flourish through embracing diversity into their business strategy, and developing talent at every level in the organisation.

For this purpose, the Company takes into consideration various aspects such as broad industry experience, knowledge, independence, gender, age and cultural and educational background for the Board appointments.

Diversity of Knowledge, Skills, and Competencies

In synchronicity with the law, the Company requires its Board Members to hold collectively, bear, and exhibit a diversity of knowledge, skills, competencies, and experiences, to adequately supervise, direct, advise and make decisions regarding the Company’s authorized services and activities.

The Company shall consider the following factors in measuring and determining the diversity, breadth, and sufficiency of the knowledge, skills, and experience of Members:

- Academic and other institutional qualifications

- Tenures of previous employment

- Memberships to various professional bodies,

- Positions of service or membership to other companies’ Boards (with due consideration to prevent and avoid conflicts of interest),

- Professional and institutional licenses

- Hard and soft professional skills and traits

- Persons of good repute and bearing integrity, honesty, independence of mind

- Any other factors that are brought before the Nomination Committee or that the Committee considers relevant.

The above-mentioned factors have a broad application and are not limited to knowledge, experience or skills necessarily gained in investment firms, but can have been attained in professional practice in a range of industries including, but not limited to, other financial services, information technology, legal and accounting professions, and any other professional fields regardless of relevance directly to the investment sector, but where the practicing or holding professional understands the Company’s activities including its principal risks and bears general competencies, skills, traits and experiences that add value, relevance or application to the Board of the Company. To this end, the Company must ensure that the overall composition of its Board of Directors reflects an adequately broad range of experiences.

Legal Purpose and Requirement for Broad Representation of the Board

The Board of Directors bears important governance responsibilities to the Company, investors, and the markets. It bears overall responsibility for the Company, including ensuring the integrity of accounting and financial reporting, supervising senior management and challenging management decisions where necessary, overseeing the Company’s policies and operations, disclosures and announcements, decision-making, and governing the Company in accordance with the Law(s). These responsibilities are of a gravity that requires the Members to act with honesty, integrity, and independence of mind, be of good repute and possess sufficient knowledge, skills, and experience to perform their duties. The Diversity considerations above ensure that the Board is collectively and compositely broad and adequate enough to be able to perform the full scope and extent of their duties, and also appropriately guides the nomination process.

Operational Duties of the Company

The Company shall devote adequate human and financial resources towards the induction and training of the Board to ensure the application of diversified knowledge and skills is relevant and compliant with the law and regulations.

The Board of Directors of the company has full competence in the process of selection and appointment of any of its members and shall consider the following (akin to the Nomination Committee that would be established in a large and systemically significant investment firm) in its selection and appointment endeavors:

- Identification and recommendation of new directors or candidates to fill vacancies in the Board

- Evaluation of the balance of knowledge, skills, diversity, and experience of the Board of Directors

- Provide a description of the roles and capabilities required for a particular appointment

- Assess the time commitment that is expected of Directors

- Prepare targets for gender representation of the Board, address and /or balance any under representations and publish this information as directed

- At least annually, assess the structure, size, composition, and performance of the Board and make recommendations to the board of directors with regard to any changes; and report to Board

- At least annually, assess the individual and collective knowledge, skills, and experience of Directors and report to the Board

- Review the policy for senior management selection and appointment

- Ensure that the Board is not dominated by one person or group in a manner that is detrimental to the interests of the Company as a whole

- be able to use any type of resources that it considers to be appropriate, including external advisors, and shall receive appropriate funding to that effect.

- Instill hiring policies and practices that promote and enounce the appointment of a member of members of the Board, that bear, offer, and apply a multitude of relevant exposure, skills, knowledge, competencies, and aptitudes to the Board’s composition and representation

-

Shall count the following as directorship:

- Members of the Board that are within the same group

- Directors and members of the same institutional protection scheme

- Directors of companies in which the CIF has a qualifying holding

- Appoint directors who devote sufficient time to their roles, and ensure that such commitment is met

- Provide guidelines for the appointment and removal of Directors as required for the enunciation of diversity and sufficient and adequate individual and collective representation of knowledge, skills, and experience of appointed Directors and members of the Board

- Ensure that 2 directors are members of management and therefore executive directors

- Ensure that the Chairman of the Board is not the CEO of the Company

-

Shall not appoint more than one of the following combinations of directorships at the same time:

- 1 (One) executive and 2 non-executive directorships

- 4 (Four) non-executive directorships

2.5. Information flow on risk to the board

Risk information flows up to the Board directly from the business departments and control functions. The Board ensures that it receives on a frequent basis, at least annually written reports regarding Internal Audit, Compliance, Money Laundering and Terrorist Financing and Risk Management issues and approves the Company’s ICARA report as shown in the table below:

Table 5: Information flow on risk to board

|

No. |

Report Name |

Owner of Report |

Recipient |

Frequency |

|

1 |

Risk Manager’s Report |

Risk Manager |

Senior Management, Board, CySEC |

Annually |

|

2 |

IF CLASS2 Ind |

Risk Manager |

Senior Management, Board, CySEC |

Quarterly |

|

3 |

ICARA Report |

Risk Manager |

Senior Management, Board |

Annually |

|

4 |

Disclosures & Market Discipline Report |

Risk Manager |

Senior Management, Board |

Annually |

|

5 |

Risk Register |

Risk Manager |

Senior Management, Board |

Annually |

|

6 |

Compliance Report |

Compliance Officer |

Senior Management, Board, CySEC |

Annually |

|

7 |

Internal Audit Report |

Internal Auditor |

Senior Management, Board, CySEC |

Annually |

|

8 |

Anti-money laundering (AMLCO) Report |

Anti-money laundering Compliance Officer |

Senior Management, Board, CySEC |

Annually |

|

9 |

Audited Financial Statements |

External Auditor |

Senior Management, Board, CySEC |

Annually |

|

10 |

Form 165-03 ‘Prudential Supervision Information’ |

Risk Manager |

Senior Management, Board, CySEC |

Annually |

|

11 |

Remuneration Reporting |

Finance Department & Risk Manager |

Senior Management, Board, CySEC |

Annually |

Furthermore, the Company believes that the risk governance processes and policies are of at most importance for its effective and efficient operations. The processes are reviewed and updated on an annual basis or when deemed necessary.

3. OWN FUNDS

Own Funds (also referred to as capital resources) are the type and level of regulatory capital that must be held to enable the Company to absorb losses.

During the year under review, the primary objective of the Company with respect to capital management was to ensure that it complied with the imposed capital requirements with respect to its own funds and that the Company maintained healthy capital ratios in order to support its business. Further to the above, the Company, as a Class 2 investment firm, shall at all times have own funds at least the highest of the following:

Initial minimum requirement,

Fixed Overheads Requirements, and

K-Factors Requirement.

The Company throughout the year under review, managed its capital structure and made adjustments to it in light of the changes in the economic and business conditions and the risk characteristics of its activities.

3.1. Composition of regulatory own funds

The Company shall disclose information relating to their own funds according to Article 49(a) and (c) of IFR.

The following information provides a full reconciliation of the Common Equity Tier 1 (CET1) and Additional Tier 1 (AT1) instruments and Tier 2 (T2) instruments issued by the Company. The Company’s regulatory capital comprises fully of CET1 capital while it has not issued any AT1 or T2 capital.

The composition of the Company’s Own Funds which is cross-referenced to the corresponding rows in table EU IF CC2 is shown below:

Table 6: IF CC1.01 - Composition of regulatory own funds as at 31 December 2023

|

Common Equity Tier 1 (CET1) capital: instruments and reserves |

Amounts €’000 |

Source based on reference numbers/letters of the balance sheet in the audited financial statements (EU IF CC2) |

|

|

1 |

OWN FUNDS |

3,245 |

|

|

2 |

TIER 1 CAPITAL |

3,245 |

|

|

3 |

COMMON EQUITY TIER 1 CAPITAL |

3,245 |

|

|

4 |

Fully paid up capital instruments |

2 |

Equity 1 |

|

5 |

Share premium |

130 |

Equity 2 |

|

6 |

Retained earnings |

2,545 |

Equity 4 |

|

7 |

Accumulated other comprehensive income |

- |

N/A |

|

8 |

Other reserves |

582 |

Equity 3 |

|

9 |

Minority interest given recognition in CET1 capital |

- |

N/A |

|

10 |

Adjustments to CET1 due to prudential filters |

- |

N/A |

|

11 |

Other funds |

- |

N/A |

|

12 |

(-)TOTAL DEDUCTIONS FROM COMMON EQUITY TIER 1 |

14 |

|

|

13 |

(-) Own CET1 instruments |

- |

N/A |

|

14 |

(-) Direct holdings of CET1 instruments |

- |

N/A |

|

15 |

(-) Indirect holdings of CET1 instruments |

- |

N/A |

|

16 |

(-) Synthetic holdings of CET1 instruments |

- |

N/A |

|

17 |

(-) Losses for the current financial year |

- |

N/A |

|

18 |

(-) Goodwill |

- |

N/A |

|

19 |

(-) Other intangible assets |

- |

N/A |

|

20 |

(-) Deferred tax assets that rely on future profitability and do not arise from temporary differences net of associated tax liabilities |

0 |

Assets 4 |

|

21 |

(-) Qualifying holding outside the financial sector which exceeds 15% of own funds |

- |

N/A |

|

22 |

(-) Total qualifying holdings in undertaking other than financial sector entities which exceeds 60% of its own funds |

- |

N/A |

|

23 |

(-) CET1 instruments of financial sector entities where the institution does not have a significant investment |

- |

N/A |

|

24 |

(-) CET1 instruments of financial sector entities where the institution has a significant investment |

- |

N/A |

|

25 |

(-)Defined benefit pension fund assets |

- |

N/A |

|

26 |

(-) Other deductions |

13 |

Assets 3 |

|

27 |

CET1: Other capital elements, deductions and adjustments |

- |

N/A |

|

28 |

ADDITIONAL TIER 1 CAPITAL |

- |

|

|

29 |

Fully paid up, directly issued capital instruments |

- |

N/A |

|

30 |

Share premium |

- |

N/A |

|

31 |

(-) TOTAL DEDUCTIONS FROM ADDITIONAL TIER 1 |

- |

|

|

32 |

(-) Own AT1 instruments |

- |

N/A |

|

33 |

(-) Direct holdings of AT1 instruments |

- |

N/A |

|

34 |

(-) Indirect holdings of AT1 instruments |

- |

N/A |

|

35 |

(-) Synthetic holdings of AT1 instruments |

- |

N/A |

|

36 |

(-) AT1 instruments of financial sector entities where the institution does not have a significant investment |

- |

N/A |

|

37 |

(-) AT1 instruments of financial sector entities where the institution has a significant investment |

- |

N/A |

|

38 |

(-) Other deductions |

- |

N/A |

|

39 |

Additional Tier 1: Other capital elements, deductions and adjustments |

- |

N/A |

|

40 |

TIER 2 CAPITAL |

- |

|

|

41 |

Fully paid up, directly issued capital instruments |

- |

|

|

42 |

Share premium |

- |

|

|

43 |

(-) TOTAL DEDUCTIONS FROM TIER 2 |

- |

|

|

44 |

(-) Own T2 instruments |

- |

N/A |

|

45 |

(-) Direct holdings of T2 instruments |

- |

N/A |

|

46 |

(-) Indirect holdings of T2 instruments |

- |

N/A |

|

47 |

(-) Synthetic holdings of T2 instruments |

- |

N/A |

|

48 |

(-) T2 instruments of financial sector entities where the institution does not have a significant investment |

- |

N/A |

|

49 |

(-) T2 instruments of financial sector entities where the institution has a significant investment |

- |

N/A |

|

50 |

Tier 2: Other capital elements, deductions and adjustments |

- |

N/A |

*According to the Circular C334, CIFs should deduct the additional Cash Buffer of 3 per thousand of the eligible funds and financial instruments of their clients as at the previous year calculated according to paragraph 11(6) of the Directive DI87-07 (operation of the ICF).

3.2. Main features of capital instruments

The Company shall disclose the main features of the CET1 and AT1 instruments and Tier 2 instruments issued according to Article 49(b) of IFR. Therefore, the Company’s capital instruments’ main features are outlined below:

Table 7: EU IF CCA - Main features of own instruments issued by the firm

|

No |

Item |

CET1 Capital |

|

1 |

Issuer |

Mexem Ltd |

|

2 |

Unique identifier (e.g. CUSIP, ISIN or Bloomberg identifier for private placement) |

549300PJTBHSU0H13E45 |

|

3 |

Public or private placement |

Private |

|

4 |

Governing law(s) of the instrument |

Cyprus Companies Law |

|

5 |

Instrument type (types to be specified by each jurisdiction) |

Ordinary Shares |

|

6 |

Amount recognised in regulatory capital (Currency in million, as of most recent reporting date) |

€2,100 |

|

7 |

Nominal amount of instrument |

€2,100 |

|

8 |

Issue price |

€1 |

|

9 |

Redemption price |

N/A |

|

10 |

Accounting classification |

Shareholder’s Equity |

|

11 |

Original date of issuance |

28/01/2016 |

|

12 |

Perpetual or dated |

Perpetual |

|

13 |

Original maturity date |

No maturity |

|

14 |

Issuer call subject to prior supervisory approval |

N/A |

|

15 |

Optional call date, contingent call dates and redemption amount |

N/A |

|

16 |

Subsequent call dates, if applicable |

N/A |

|

|

Coupons / dividends |

|

|

17 |

Fixed or floating dividend/coupon |

Floating |

|

18 |

Coupon rate and any related index |

N/A |

|

19 |

Existence of a dividend stopper |

No |

|

20 |

Fully discretionary, partially discretionary or mandatory (in terms of timing) |

N/A |

|

21 |

Fully discretionary, partially discretionary or mandatory (in terms of amount) |

N/A |

|

22 |

Existence of step up or other incentive to redeem |

No |

|

23 |

Noncumulative or cumulative |

Non-cumulative |

|

24 |

Convertible or non-convertible |

Non-convertible |

|

25 |

If convertible, conversion trigger(s) |

N/A |

|

26 |

If convertible, fully or partially |

N/A |

|

27 |

If convertible, conversion rate |

N/A |

|

28 |

If convertible, mandatory or optional conversion |

N/A |

|

29 |

If convertible, specify instrument type convertible into |

N/A |

|

30 |

If convertible, specify issuer of instrument it converts into |

N/A |

|

31 |

Write-down features |

N/A |

|

32 |

If write-down, write-down trigger(s) |

N/A |

|

33 |

If write-down, full or partial |

N/A |

|

34 |

If write-down, permanent or temporary |

N/A |

|

35 |

If temporary write-down, description of write-up mechanism |

N/A |

|

36 |

Non-compliant transitioned features |

N/A |

|

37 |

If yes, specify non-compliant features |

N/A |

|

38 |

Link to the full term and conditions of the instrument (signposting) |

N/A |

3.3. Balance Sheet Reconciliation

The Company shall disclose the balance sheet included in their audited financial statements for the year-end disclosures.

As at the 31 December 2023, the reconciliation of Company’s assets and liabilities and regulatory Own Funds is shown in the following table:

Table 8: EU IFCC2 - Reconciliation of regulatory own funds to balance sheet in the audited financial statements

|

No. |

Item |

Balance sheet as in published/ audited financial statements €’000 |

Under regulatory scope of consolidation

€’000 |

Cross reference to EU IF CC1 |

|

Assets - Breakdown by asset classes according to the balance sheet in the audited financial statements |

||||

|

1 |

Property, plant and equipment |

27 |

- |

N/A |

|

2 |

Right-of-use assets |

33 |

- |

N/A |

|

3 |

Investors' Compensation Fund |

13 |

- |

26 |

|

4 |

Deferred tax assets |

0 |

- |

20 |

|

5 |

Trade and other receivables |

1,823 |

- |

N/A |

|

6 |

Cash and cash equivalents |

2,176 |

- |

N/A |

|

xxx |

Total Assets |

4,072 |

- |

|

|

Liabilities - Breakdown by liability classes according to the balance sheet in the audited financial statements |

||||

|

1 |

Lease liabilities |

35 |

- |

N/A |

|

2 |

Trade and other payables |

96 |

- |

N/A |

|

3 |

Tax liability |

682 |

- |

N/A |

|

xxx |

Total Liabilities |

814 |

- |

|

|

Shareholders' Equity |

||||

|

1 |

Share capital |

2 |

- |

4 |

|

2 |

Share premium |

130 |

- |

5 |

|

3 |

Non-reciprocal contributions |

582 |

- |

8 |

|

4 |

Retained earnings |

2,545 |

- |

6 |

|

xxx |

Total Shareholders' equity |

3,259 |

- |

|

4. PRUDENTIAL REQUIREMENTS 4.1.Own Funds Requirement

The Company as a Class 2 investment firm shall at all times have own funds at least the highest

of Initial Capital, Fixed Overheads and K-Factors Requirements.

4.1.1. Initial Capital Requirement

As per the Title III of the Law, the initial capital of a CIF which is authorised to provide any of the investment services or perform any of the investment activities listed in points (3) and (6) of Part I of Annex I to the Investment Services and Activities and Regulated Markets Law, shall be

€750k while for a CIF which is authorised to provide any of the investment activities listed in points (1), (2), (4), (5) and (7) which is not permitted to hold clients’ money or securities belonging to its clients, the initial capital shall be €75k. For all other CIFs, the initial capital shall be €150k. Therefore, since the Company is not authorised to provide the investment service of dealing on own account and is not permitted to hold clients’ money its initial capital is €75k. However and upon activation of the ancillary service of Safekeeping and Administration of financial instruments for the account of clients, the Company’s Initial Capital will increase to

€150k.

4.1.2. Fixed Overheads requirement

The fixed overheads requirement (FOR) applies to all CIFs. The FOR is intended to calculate a minimum amount of capital that a CIF would need available to absorb losses if it has cause to wind-down or exit the market. It is calculated as the one quarter of the fixed overheads of the preceding year (or business plan where the audited financial statements are not available) in accordance with the provision of Article 13 of IFR. Furthermore, the Company’s fixed overheads requirement based on the latest audited financial statements is €755k as per the table below:

Table 9: Fixed Overheads Requirement

|

Item |

€’000 |

|

Total expenses of the previous year after distribution of profits |

13,922 |

|

Total deductions |

10,901 |

|

(-)Staff bonuses and other remuneration |

|

|

(-)Employees', directors' and partners' shares in net profits |

|

|

(-)Other discretionary payments of profits and variable remuneration |

|

|

(-)Shared commission and fees payable |

9,639 |

|

(-)Fees, brokerage and other charges paid to CCPs charged to customers |

|

|

(-)Fees to tied agents |

|

|

(-)Interest paid to customers on client money |

|

|

(-)Non-recurring expenses from non-ordinary activities |

24 |

|

(-)Expenditures from taxes |

1,238 |

|

(-)Losses from trading on own account in financial instruments |

|

|

(-)Contract based profit and loss transfer agreements |

|

|

(-)Expenditure on raw materials |

|

|

(-)Payments into a fund for general banking risk |

|

|

(-)Expenses related to items that have already been deducted from own funds |

|

|

Annual Fixed Overheads |

3,020 |

|

Fixed Overheads requirement |

755 |

The K-factors capital requirement is essentially a mixture of activity- and exposure-based requirements. The K-factors which apply to an individual investment firm will depend on the MiFID investment services and activities it undertakes. Capital requirement from applying K- factors formula is the sum of Risk to Client (‘RtC’), Risk to Market (‘RtM’) and Risk to Firm (‘RtF’).

The Company as a Class 2 IF is required to calculate K-Factors capital requirement as the sum of RtC (K-AUM, K-COH) and RtM (K-NPR only for on-balance sheet FX risk exposures) based on the Company’s model. The RtF proxy is not applicable for the Company as it is not authorized to provide the investment service of Dealing on Own Account.

Risk to Client

The risk to Client proxy captures the risk that may be inflicted onto the clients. RtC exists in the activities/services of the firm which are related to the client and are measured as a percentage of Clients Money Held (CMH), Assets Under Management (AUM), Assets Safeguarded & Administered (ASA) and Clients’ Orders Handled (COH).

The Company is required to calculate the following K-Factors requirements as part of the RtC:

K-AUM: Assets Under Management

K‐AUM captures the risk of harm to clients from an incorrect discretionary management of client portfolios or poor execution and provides reassurance and client benefits in terms of the continuity of service of ongoing portfolio management and investment advice.

AUM is the value of assets an IF manages for its clients under both discretionary portfolio management and non-discretionary arrangements constituting investment advice of an ongoing nature.

Calculation

AUM shall be the rolling average of the value of the total monthly assets under management, measured on the last business day of each of the previous 15 months, excluding the 3 most recent monthly values.

K-AUM shall be the arithmetic mean of the remaining 12 monthly values multiplied by the relevant coefficient of 0.02%.

As at 31 December 2023, the K-AUM was €3k.

The table below shows the Total AUM amounts as an arithmetic mean for the 4th quarter of 2023 in accordance with the Article 17(1) of IFR:

Table 10: Total AUM (average amounts)

|

|

Factor amount |

||

|

December 2023 €’000 |

November 2023 €’000 |

October 2023 €’000 |

|

|

Total AUM (average amounts) |

13,806 |

12,798 |

11,709 |

K-CMH: Clients Money Held

K‐CMH captures the risk of potential for harm where an investment firm holds the money of its clients, taking into account whether they are on its own balance sheet or in third‐party accounts and arrangements under applicable national law provided that client money is safeguarded in the event of bankruptcy, insolvency, or entry into resolution or administration of the investment firm.

CMH is the amount of client money that an investment firm holds or controls. It excludes client money that is deposited on a (custodian) bank account in the name of the client itself, where the investment firm has access to these client funds via a third-party mandate (on a segregated or nonsegregated basis).

Calculation

CMH shall be the rolling average of the value of total daily client money held, measured at the end of each business day for the previous 9 months, excluding the 3 most recent months.

K-CMH shall be the arithmetic mean of the daily values from the remaining 6 months multiplied by the relevant coefficient (0.4% and for segregated accounts and 0.5% for non- segregated accounts).

The Company is not permitted to hold clients’ money and as such the K-CMH does not apply to the Company.

K-ASA: Assets Safeguarded and Administered

K‐ASA captures the risk of safeguarding and administering client assets, and ensures that investment firms hold capital in proportion to such balances, regardless of whether they are on its own balance sheet or in third‐party accounts.

ASA means the value of assets that an investment firm safeguards and administers for clients – ensuring that investment firms hold capital in proportion to such balances, regardless of whether they are on its own balance sheet or in third-party accounts.

Calculation

It is calculated as the rolling average of the daily total value of assets under safekeeping and administration, measured at the end of each business day for the previous 9 months, excluding the 3 most recent months.

K-ASA shall be the arithmetic mean of the daily values from the remaining 6 months multiplied by the relevant coefficient of 0.04%.

During the year under review, the Company was not subject to the risk relating to K-ASA since it is not permitted to hold client assets.

K-COH: Client Orders Handled

K‐COH captures the potential risk to clients of an investment firm which executes orders (in the name of the client, and not in the name of the investment firm itself), for example as part of execution‐only services to clients or when an investment firm is part of a chain for client orders.

COH captures the potential risk to clients of an investment firm which executes its orders (in the name of the client). This is the value of orders that an investment firm handles for clients, through the reception and transmission of client orders and execution of orders on behalf of clients.

Calculation

COH shall be the rolling average of the value of the total client orders handled, measured throughout each business day for the previous 6 months.

K-COH shall be the arithmetic mean of the daily values from the remaining 3 months multiplied by the relevant coefficient (0.1% and for cash trades and 0.01% for derivative trades).

As at 31 December 2023, the K-COH was €243k. The table below shows the arithmetic mean amount of COH in cash trades and derivatives for the 4th quarter of 2023, in accordance with the Article 20(1) of IFR:

Table 11: Total COH (average amounts)

|

|

Factor amount |

||

|

December 2023 €’000 |

November 2023 €’000 |

October 2023 €’000 |

|

|

COH - Cash trades (average amounts) |

188,077 |

183,556 |

168,462 |

|

COH - Derivative (average amounts) |

549,250 |

550,539 |

516,718 |

Risk to Market

The Risk to market proxy captures the risk an IF can pose to market access. The K-factor for RtM is based on the rules for market risk, for position in financial instruments in foreign exchange and in commodities in accordance with the CRR.

K-NPR: Net Position Risk

A Class 2 investment firm must calculate its K-NPR requirement by reference to trading book positions and positions other than trading book positions where the positions give rise to foreign exchange risk or commodity risk. The K-NPR requirement is calculated in accordance with Title IV of Part Three of the CRR.

The Company is exposed to K-NPR from on-balance sheet items denominated in a non- reporting currency. As at 31 December 2023, the K-NPR capital requirements amounted to zero.

Foreign Exchange Risk

Foreign exchange risk is the effect that unanticipated exchange rate changes may have on the Company. In the ordinary course of business, the Company is exposed to foreign exchange risk, which is monitored through various control mechanisms.

The foreign exchange risk in the Company is effectively managed by setting and controlling foreign exchange risk limits, such as through the establishment of a maximum value of exposure to a particular currency pair as well as through the utilization of sensitivity analysis.

The Company’s foreign exchange risk capital requirement is zero emanating from a net foreign exchange exposure of €1 based on the latest relevant calculations of the Company’s capital requirements as at 31 December 2023.

The Company continues to regularly monitor the impact of exchange rate risks and if deemed necessary, corrective actions will be taken to minimize the effect.

K-Factors Requirement Results

As at 31 December 2023, the Company’s K-Factors Requirement is €246k as shown in the table below:

Table 12: K-Factors Results

|

Item |

Factor Amount €’000 |

K-Factor Requirement €’000 |

|

TOTAL K-FACTOR REQUIREMENT |

|

246 |

|

Risk To clients |

|

246 |

|

K-AUM |

13,806 |

3 |

|

K-CMH (Segregated) |

- |

- |

|

K-CMH (non-Segregated) |

- |

- |

|

K-ASA |

- |

- |

|

K-COH (Cash Trades) |

188,077 |

188 |

|

K-COH (Derivative Trades) |

549,250 |

55 |

|

Risk to Market |

|

- |

|

K-NPR |

|

- |

|

K-CMG |

- |

- |

|

Risk to Firm |

|

- |

|

K-TCD |

|

- |

|

K-DTF (Cash Trades) |

- |

- |

|

K-DTF (Derivative Trades) |

- |

- |

|

K-CON |

|

- |

4.2. Capital Ratios

According to Article 9 of the IFR, Investment firms shall have own funds consisting of the sum of their Common Equity Tier 1 capital, Additional Tier 1 capital and Tier 2 capital, and shall meet all the following conditions at all times:

The Company’s own funds, own funds requirement and capital ratio reported as at 31 December 2023, were the following:

Table 13: Capital Adequacy Analysis

|

OWN FUNDS COMPOSITION |

€’000 |

|

Total Own Funds |

3,245 |

|

|

|

|

OWN FUNDS REQUIREMENTS |

€’000 |

|

Initial Capital |

75 |

|

Fixed Overheads Requirement |

755 |

|

K-Factors Requirement |

246 |

|

Own funds Requirement |

755 |

|

|

|

|

CAPITAL RATIOS |

|

|

CET 1 (min. 56%) |

429.72% |

|

Surplus(+)/Deficit(-) of CET 1 Capital |

2,822 |

|

Tier 1 (min. 75%) |

429.72% |

|

Surplus(+)/Deficit(-) of Tier 1 Capital |

2,679 |

|

Total (min. 100%) |

429.72% |

|

Surplus of Total capital |

2,490 |